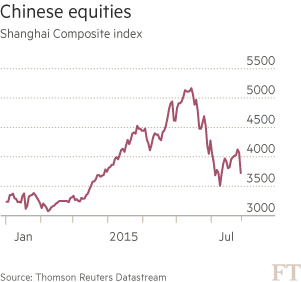

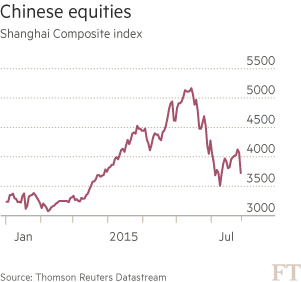

The business media is full of the meltdown of the Chinese stock market, the credit bubble and impending crash in the Chinese economy. But less well announced is the dangerous economic slowdown and already unfolding debt crisis in ‘emerging economies’ in general.

So for the first time since the emerging market crisis of 1998, all the large so-called BRICS (Brazil, Russia, India, China and South Africa) are in trouble. And so are the next range of ‘developing’ economies like Indonesia, Thailand, Turkey, Argentina, Venezuela etc.

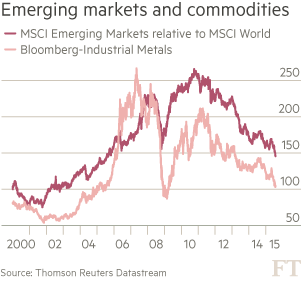

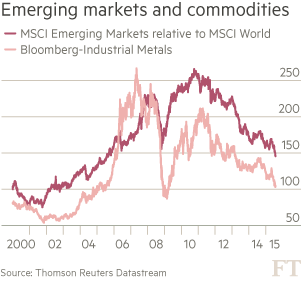

Previously rising commodity prices in oil, base metals and food led to fast growth in many of these economies. This in turn led to a flood of capital from advanced capitalist economies by banks and companies looking for higher profits than available in their economies.

But the commodity boom has collapsed. Global commodity prices continue to plunge. Bloomberg’s commodity price index, tracking gold, crude oil and other raw materials, is down to its lowest point since 2002. It has fallen by 40% since 2011. It’s another indicator of the long depression and deflationary pressures in the world economy (see my post: https://thenextrecession.wordpress.com/…/the-spectre-of-de…/).

That’s partly because of the Great Recession and the weak recovery afterwards has reduced demand for energy and industrial materials. And it is partly because the biggest consumer of these goods, China, has seen its economy slow in growth from double digits to (just) 7% a year or even lower. Inflation in many top economies has given way to deflation in prices (in Europe and Japan).

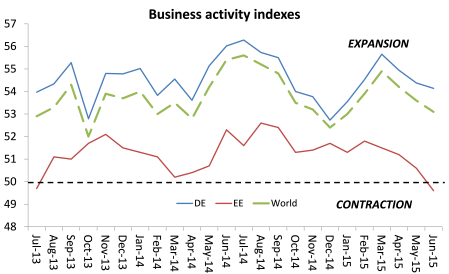

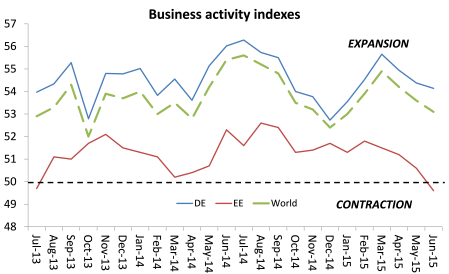

The latest ‘flash’ estimates of business activity globally, based on the so-called purchasing managers indexes, show that emerging economies are now contracting for the first time for over two years.

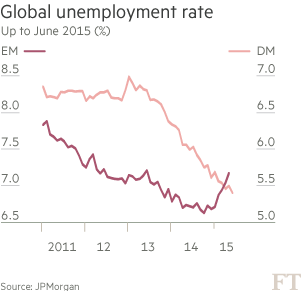

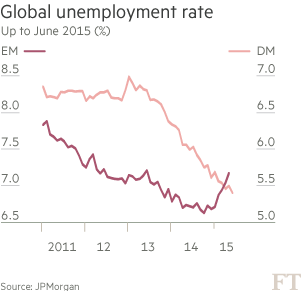

Unemployment across emerging markets has risen sharply this year, reversing a six-year slide, even as it has continued to fall in developed countries. Across emerging markets, unemployment has risen to 5.7 per cent, from a cyclical low of 5.2 per cent in January, the sharpest rise since the global financial crisis, according to figures compiled by JPMorgan.

During the emerging market boom, capital flowed into the emerging economies and corporations in Asia and Latin America ran up large debts. Now the money is flowing out, not in and profits are falling as prices for commodities and sales of even for hi-tech goods are falling. Investors pulled a net $4.5bn from EM funds in the week through July 30, according to data from EPFR, compared with $3.3bn a week earlier. A total of $14.5bn has now been redeemed from EM funds over the past three weeks alone.

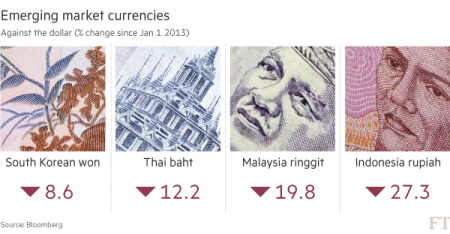

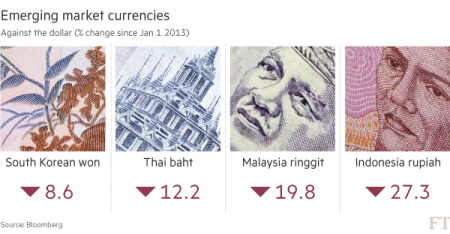

And currencies across Asia are dropping like stones.

And the US is poised to raise rates in September, so emerging markets could suffer further instability as the cost of servicing that debt rises in dollar terms. A debt crisis is emerging.

The latest data on foreign exchange reserves show a sharp fall in dollar reserves. The reserves of emerging market governments have slumped as these governments experience declining trade surpluses and weak domestic economies, leading to a flight of money. The IMF’s COFER figures, the measure for FX reserve data, show that emerging-market reserves have dropped for three successive quarters, from a peak of $8.06trn at end Q2 2014 to $7.5trn by end Q1 2015. These analysts reckon that emerging-market reserves have fallen $575bn since the middle of last year, the sharpest decline in 20 years. Capital is fleeing these ’emerging economies’ as their real GDP growth slows and investment drops off.

Investment bank JP Morgan reckons that the debt of non-financial corporations in emerging economies has surged from about 73% of GDP before the financial crisis to 106% of GDP as of 4Q14. This 34%-point increase is enormous, averaging nearly 5%-points per year since 2007. In previous research, the IMF has found that an increase in the ratio of credit to GDP of 5%-points or more in a single year signals a heightened risk of an eventual financial crisis. Many emerging market economies have registered such an increase since 2007. Hence the conclusion of the credit analysts, S&P, that “we have reached an inflexion point in the corporate credit cycle”.

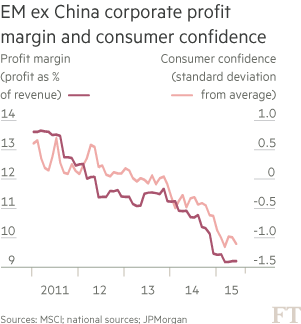

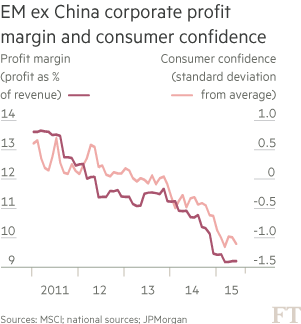

Alongside rising debt are falling profitability and consumer demand in emerging markets outside China.

Falling commodity prices for emerging economy exports, rising corporate debt, falling profitability and demand, significant capital outflows and the probability that the US Fed will hike rates this autumn/fall and increase debt servicing costs. It’s a concoction for a serious crash/slump in the great ‘growth’ story of the ’emerging’ economies.

So for the first time since the emerging market crisis of 1998, all the large so-called BRICS (Brazil, Russia, India, China and South Africa) are in trouble. And so are the next range of ‘developing’ economies like Indonesia, Thailand, Turkey, Argentina, Venezuela etc.

Previously rising commodity prices in oil, base metals and food led to fast growth in many of these economies. This in turn led to a flood of capital from advanced capitalist economies by banks and companies looking for higher profits than available in their economies.

But the commodity boom has collapsed. Global commodity prices continue to plunge. Bloomberg’s commodity price index, tracking gold, crude oil and other raw materials, is down to its lowest point since 2002. It has fallen by 40% since 2011. It’s another indicator of the long depression and deflationary pressures in the world economy (see my post: https://thenextrecession.wordpress.com/…/the-spectre-of-de…/).

That’s partly because of the Great Recession and the weak recovery afterwards has reduced demand for energy and industrial materials. And it is partly because the biggest consumer of these goods, China, has seen its economy slow in growth from double digits to (just) 7% a year or even lower. Inflation in many top economies has given way to deflation in prices (in Europe and Japan).

The latest ‘flash’ estimates of business activity globally, based on the so-called purchasing managers indexes, show that emerging economies are now contracting for the first time for over two years.

Unemployment across emerging markets has risen sharply this year, reversing a six-year slide, even as it has continued to fall in developed countries. Across emerging markets, unemployment has risen to 5.7 per cent, from a cyclical low of 5.2 per cent in January, the sharpest rise since the global financial crisis, according to figures compiled by JPMorgan.

During the emerging market boom, capital flowed into the emerging economies and corporations in Asia and Latin America ran up large debts. Now the money is flowing out, not in and profits are falling as prices for commodities and sales of even for hi-tech goods are falling. Investors pulled a net $4.5bn from EM funds in the week through July 30, according to data from EPFR, compared with $3.3bn a week earlier. A total of $14.5bn has now been redeemed from EM funds over the past three weeks alone.

And currencies across Asia are dropping like stones.

And the US is poised to raise rates in September, so emerging markets could suffer further instability as the cost of servicing that debt rises in dollar terms. A debt crisis is emerging.

The latest data on foreign exchange reserves show a sharp fall in dollar reserves. The reserves of emerging market governments have slumped as these governments experience declining trade surpluses and weak domestic economies, leading to a flight of money. The IMF’s COFER figures, the measure for FX reserve data, show that emerging-market reserves have dropped for three successive quarters, from a peak of $8.06trn at end Q2 2014 to $7.5trn by end Q1 2015. These analysts reckon that emerging-market reserves have fallen $575bn since the middle of last year, the sharpest decline in 20 years. Capital is fleeing these ’emerging economies’ as their real GDP growth slows and investment drops off.

Investment bank JP Morgan reckons that the debt of non-financial corporations in emerging economies has surged from about 73% of GDP before the financial crisis to 106% of GDP as of 4Q14. This 34%-point increase is enormous, averaging nearly 5%-points per year since 2007. In previous research, the IMF has found that an increase in the ratio of credit to GDP of 5%-points or more in a single year signals a heightened risk of an eventual financial crisis. Many emerging market economies have registered such an increase since 2007. Hence the conclusion of the credit analysts, S&P, that “we have reached an inflexion point in the corporate credit cycle”.

Alongside rising debt are falling profitability and consumer demand in emerging markets outside China.

Falling commodity prices for emerging economy exports, rising corporate debt, falling profitability and demand, significant capital outflows and the probability that the US Fed will hike rates this autumn/fall and increase debt servicing costs. It’s a concoction for a serious crash/slump in the great ‘growth’ story of the ’emerging’ economies.

No hay comentarios:

Publicar un comentario