Crude oil prices have hit a seven-year low after last week’s decision in Vienna of OPEC, the oil cartel, not to put any limit on oil production next year.

Demand for oil has slowed sharply and oil stocks have built up to a record 3bn barrels while oil tankers circle the waters around refineries in the US and Europe unable to unload because there is no demand.

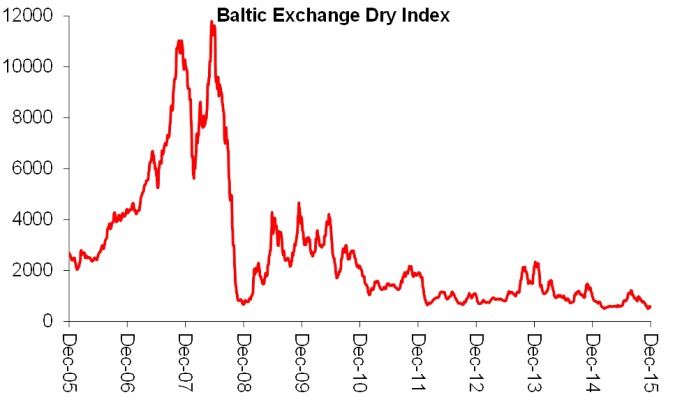

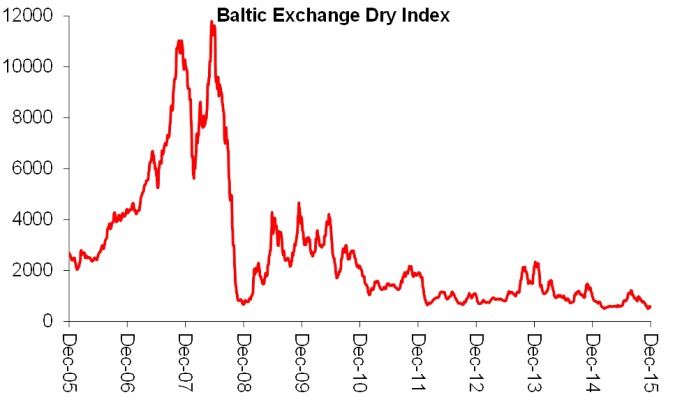

At the same time, the prices of important raw materials like iron ore and copper hit new lows. The transport of these resources in ‘bulk carriers has collapsed, as measured by the so-called Baltic dry index, now at a 30-year low.

As a result, the large so-called emerging economies like Russia, Brazil and South Africa, where exports are mainly energy and other raw materials for the industrial and consumer economies of the mature capitalist world, slipped into economic recession, with their currency values collapsing. The largest consumer of these raw materials was China, but that economy has seen a significant slowdown in real GDP growth and is stockpiling its own steel, iron ore and copper, or trying to dump them abroad at low prices.

In a previous post in the summer, I pinpointed this growing crisis for the previously booming ‘emerging economies’. Their booming economies took off through the exports of raw materials and energy. They financed the boom by borrowing at very cheap rates in dollars from the banks of the West. But now with the collapse of their exports and falling prices, these debts are going to become much more difficult to pay back.

Financial firms in developing economies repaid a net $15 billion of international debt in the third quarter, while nonfinancial companies issued just $6 billion in new debt. Both figures were the lowest since the beginning of 2009, according to a report by the Bank of International Settlements (BIS). Emerging market companies are starting to default more often than US borrowers, the first time that’s happened in years.

Next week, the US Federal Reserve is planning to raise its policy rate for the first time in almost a decade. So the cheap debt that the emerging economies have borrowed will get more expensive to service. The face value of dollar-denominated emerging-markets sovereign and corporate debt has roughly tripled since the beginning of 2009, to $1.7 trillion, according to Bank of America Merrill Lynch index data. These emerging nations are just starting to feel the weight of their mountain of debt.

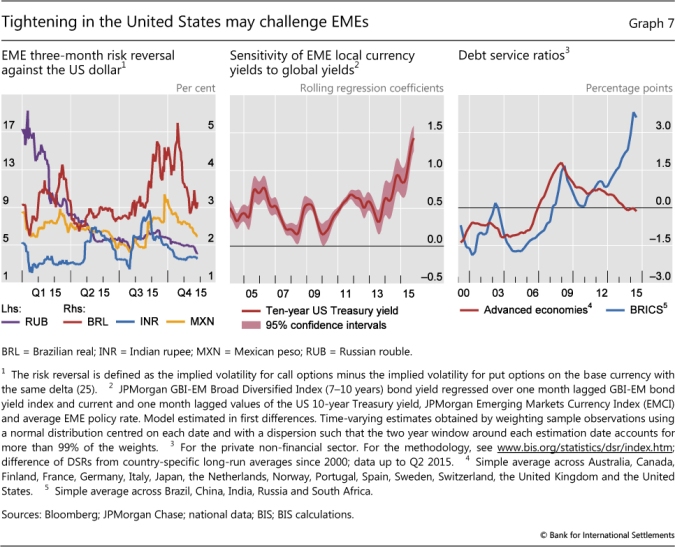

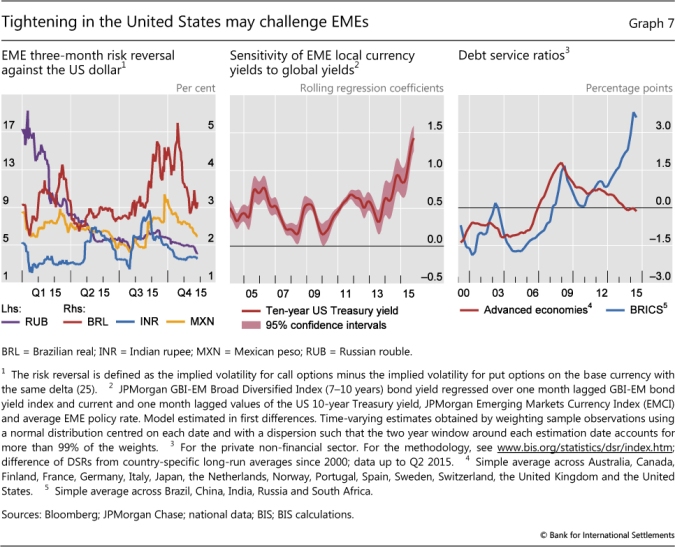

The BIS report reckons that the cost of borrowing in these emerging economies is very sensitive to Fed interest rates.

When in 2014, the Fed decided to end its quantitative easing measures (printing money), this caused what was called a ‘taper tantrum’ in emerging economies, where stock and bond markets plunged in value. Now the BIS says “There have also been signs that EM local currency yields are increasingly sensitive to developments in the United States. The post-crisis era has been characterised by strong international spillovers from US bond yields to emerging markets, even when those countries were at different stages of the business cycle. And this effect seems to have strengthened over time. A simple rolling regression of an EME bond index on US 10-year Treasury yields suggests that the potential for spillovers is larger now than it was during the taper tantrum”.

The BIS is worried that these tighter financial conditions “may also increase financial stability risks”. Average credit-to-GDP ratios in the major EMs has risen by close to 25% since 2010. “Despite low interest rates, rising debt levels have pushed debt service ratios for households and firms above their long-run averages, particularly since 2013, signalling increased risks of financial crises in EMEs. Debt service ratios will inevitably increase even further when lending rates start to rise. Any further appreciation of the dollar would additionally test the debt servicing capacity of EME corporates, many of which have borrowed heavily in US dollars in recent years.”

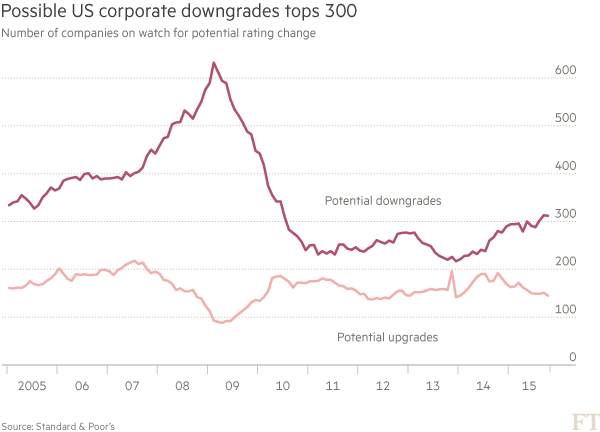

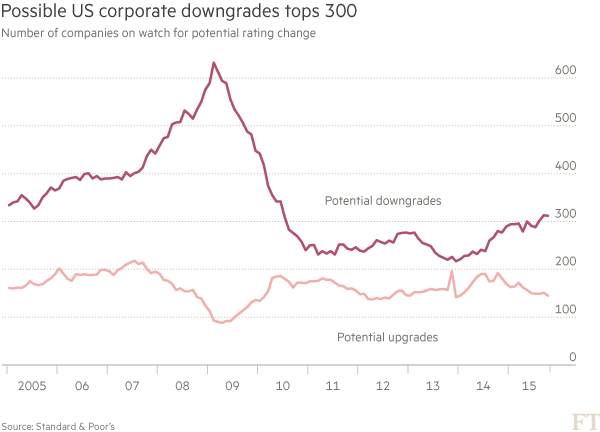

If emerging economies get into a debt crisis with companies defaulting and banks going bust, the mature capitalist economies will not avoid the impact. As it is, corporate debt has risen sharply in the US and Europe as companies there have taken advantage of cheap loans to stack on cash. But as corporate profit growth has slowed to a trickle in the last year, corporate defaults and debt downgrades have risen, and this is before the Fed hikes its rate.

More than $1tn in US corporate debt has been downgraded this year as defaults climb to post-crisis highs, underlining investor fears that the credit cycle has entered its final innings. Much of the decline in ‘fundamentals’ has been linked to the significant slide in commodity prices, with failures in the energy and metals and mining industries making up a material part of the defaults recorded thus far.

Some 102 companies have defaulted since the year’s start, including 63 in the US. Only three companies in the country have retained a coveted triple A rating: ExxonMobil, Johnson & Johnson and Microsoft, with the oil major on review for possible downgrade. A large portion of the lowest quality debt issuers will face “severe refinancing challenges” by 2018 as cash flow generation remains weak, Matthew Mish, a credit strategist with UBS, noted.

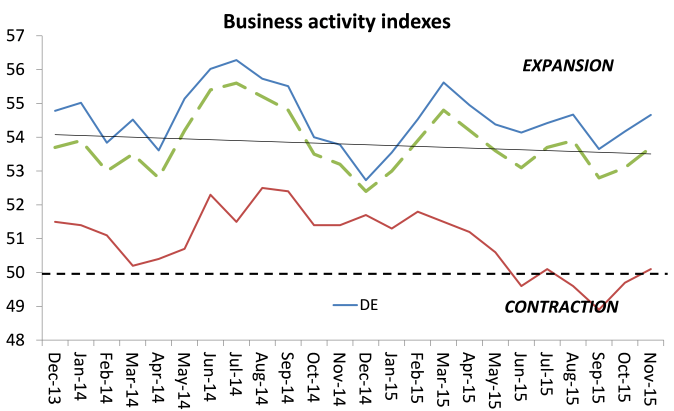

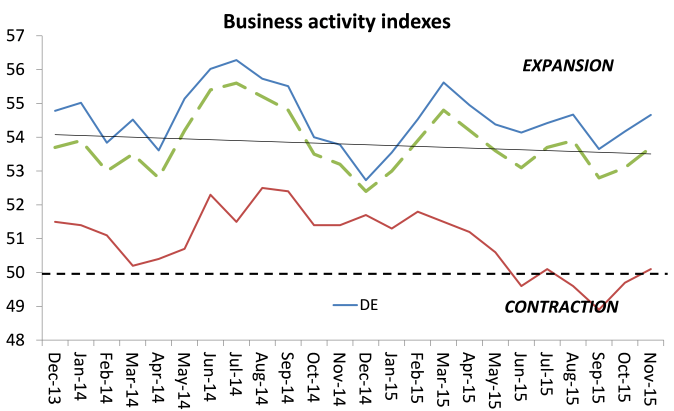

When we look at overall global business activity, as measured by the so-called purchasing managers indexes (PMIs), there was a slight pick-up in November as emerging economies (red line) stopped contracting (on average). But the world PMI (green line), while showing expansion, is still lower than it was at the beginning of 2014.

And, of course, my key measure of the future health of world economy, profits, continue to paint a dismal picture. Corporate profits in the five major economies of the US, Japan, Germany, Eurozone and the UK, are now contracting (on average) for the first time since the Great Recession.

Another disconcerting factor is the world economy could already be growing slower than the official figures show. The IMF estimates that global gross domestic product (GDP) rose about 3.1% in 2015. Yet when the IMF data for world gross national product (GWP), which includes earnings from overseas trading and income, it appears from the IMF’s own figures that the world economy contracted in nominal terms by 5% this year.

This contradictory data was considered in a recent paper. Peter van Bergjik, the author, concluded that some of the divergence between world GDP and GNP could be explained by statistical errors and currency deviations from the dollar’s value. But that would not be enough to fill the gap in the data. Van Bergijk concludes “that the official IMF forecasts for real GPP are likely to be too optimistic as has also been the case in the past. Analysing the IMF’s track record over a 20-year period, the Independent Evaluation Office (2014) reports that real economic growth has been overestimated, especially in periods of global crisis. Further downward revisions of the real economic growth rate are therefore to be expected.”

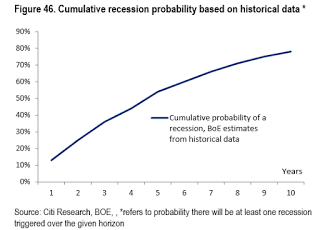

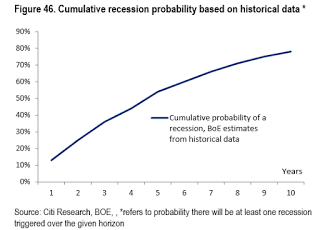

I have commented on the possibility of a new global recession in previous posts. My view is that it is due and will take place in the next one to three years at most. Some mainstream economists are now forecasting a more than 50% chance for 2016. Citibank economists reckon that there is a 65% chance in 2016.

This doom-mongering is dismissed by others. Bill McBride from Calculated Risk trashed those recession mongers who think it is on the cards for next year. Says McBride: “For the last 6+ years, there have been an endless parade of incorrect recession calls. The manufacturing sector has been weak, and contracted in the US in November due to a combination of weakness in the oil sector, the strong dollar and some global weakness. But this doesn’t mean the US will enter a recession. The last time the index contracted was in 2012 (no recession), and has shown contraction a number of times outside of a recession. Looking at the economic data, the odds of a recession in 2016 are very low (extremely unlikely in my view). “

Maybe it won’t be in 2016. But the factors for a new recession are increasingly in place: falling profitability and profits in the major economies and a rising debt burden for corporations in both mature and emerging economies. And the Fed set to hike the cost of borrowing in dollars. It’s a poisonous concoction.

Demand for oil has slowed sharply and oil stocks have built up to a record 3bn barrels while oil tankers circle the waters around refineries in the US and Europe unable to unload because there is no demand.

At the same time, the prices of important raw materials like iron ore and copper hit new lows. The transport of these resources in ‘bulk carriers has collapsed, as measured by the so-called Baltic dry index, now at a 30-year low.

As a result, the large so-called emerging economies like Russia, Brazil and South Africa, where exports are mainly energy and other raw materials for the industrial and consumer economies of the mature capitalist world, slipped into economic recession, with their currency values collapsing. The largest consumer of these raw materials was China, but that economy has seen a significant slowdown in real GDP growth and is stockpiling its own steel, iron ore and copper, or trying to dump them abroad at low prices.

In a previous post in the summer, I pinpointed this growing crisis for the previously booming ‘emerging economies’. Their booming economies took off through the exports of raw materials and energy. They financed the boom by borrowing at very cheap rates in dollars from the banks of the West. But now with the collapse of their exports and falling prices, these debts are going to become much more difficult to pay back.

Financial firms in developing economies repaid a net $15 billion of international debt in the third quarter, while nonfinancial companies issued just $6 billion in new debt. Both figures were the lowest since the beginning of 2009, according to a report by the Bank of International Settlements (BIS). Emerging market companies are starting to default more often than US borrowers, the first time that’s happened in years.

Next week, the US Federal Reserve is planning to raise its policy rate for the first time in almost a decade. So the cheap debt that the emerging economies have borrowed will get more expensive to service. The face value of dollar-denominated emerging-markets sovereign and corporate debt has roughly tripled since the beginning of 2009, to $1.7 trillion, according to Bank of America Merrill Lynch index data. These emerging nations are just starting to feel the weight of their mountain of debt.

The BIS report reckons that the cost of borrowing in these emerging economies is very sensitive to Fed interest rates.

When in 2014, the Fed decided to end its quantitative easing measures (printing money), this caused what was called a ‘taper tantrum’ in emerging economies, where stock and bond markets plunged in value. Now the BIS says “There have also been signs that EM local currency yields are increasingly sensitive to developments in the United States. The post-crisis era has been characterised by strong international spillovers from US bond yields to emerging markets, even when those countries were at different stages of the business cycle. And this effect seems to have strengthened over time. A simple rolling regression of an EME bond index on US 10-year Treasury yields suggests that the potential for spillovers is larger now than it was during the taper tantrum”.

The BIS is worried that these tighter financial conditions “may also increase financial stability risks”. Average credit-to-GDP ratios in the major EMs has risen by close to 25% since 2010. “Despite low interest rates, rising debt levels have pushed debt service ratios for households and firms above their long-run averages, particularly since 2013, signalling increased risks of financial crises in EMEs. Debt service ratios will inevitably increase even further when lending rates start to rise. Any further appreciation of the dollar would additionally test the debt servicing capacity of EME corporates, many of which have borrowed heavily in US dollars in recent years.”

If emerging economies get into a debt crisis with companies defaulting and banks going bust, the mature capitalist economies will not avoid the impact. As it is, corporate debt has risen sharply in the US and Europe as companies there have taken advantage of cheap loans to stack on cash. But as corporate profit growth has slowed to a trickle in the last year, corporate defaults and debt downgrades have risen, and this is before the Fed hikes its rate.

More than $1tn in US corporate debt has been downgraded this year as defaults climb to post-crisis highs, underlining investor fears that the credit cycle has entered its final innings. Much of the decline in ‘fundamentals’ has been linked to the significant slide in commodity prices, with failures in the energy and metals and mining industries making up a material part of the defaults recorded thus far.

Some 102 companies have defaulted since the year’s start, including 63 in the US. Only three companies in the country have retained a coveted triple A rating: ExxonMobil, Johnson & Johnson and Microsoft, with the oil major on review for possible downgrade. A large portion of the lowest quality debt issuers will face “severe refinancing challenges” by 2018 as cash flow generation remains weak, Matthew Mish, a credit strategist with UBS, noted.

When we look at overall global business activity, as measured by the so-called purchasing managers indexes (PMIs), there was a slight pick-up in November as emerging economies (red line) stopped contracting (on average). But the world PMI (green line), while showing expansion, is still lower than it was at the beginning of 2014.

And, of course, my key measure of the future health of world economy, profits, continue to paint a dismal picture. Corporate profits in the five major economies of the US, Japan, Germany, Eurozone and the UK, are now contracting (on average) for the first time since the Great Recession.

Another disconcerting factor is the world economy could already be growing slower than the official figures show. The IMF estimates that global gross domestic product (GDP) rose about 3.1% in 2015. Yet when the IMF data for world gross national product (GWP), which includes earnings from overseas trading and income, it appears from the IMF’s own figures that the world economy contracted in nominal terms by 5% this year.

This contradictory data was considered in a recent paper. Peter van Bergjik, the author, concluded that some of the divergence between world GDP and GNP could be explained by statistical errors and currency deviations from the dollar’s value. But that would not be enough to fill the gap in the data. Van Bergijk concludes “that the official IMF forecasts for real GPP are likely to be too optimistic as has also been the case in the past. Analysing the IMF’s track record over a 20-year period, the Independent Evaluation Office (2014) reports that real economic growth has been overestimated, especially in periods of global crisis. Further downward revisions of the real economic growth rate are therefore to be expected.”

I have commented on the possibility of a new global recession in previous posts. My view is that it is due and will take place in the next one to three years at most. Some mainstream economists are now forecasting a more than 50% chance for 2016. Citibank economists reckon that there is a 65% chance in 2016.

This doom-mongering is dismissed by others. Bill McBride from Calculated Risk trashed those recession mongers who think it is on the cards for next year. Says McBride: “For the last 6+ years, there have been an endless parade of incorrect recession calls. The manufacturing sector has been weak, and contracted in the US in November due to a combination of weakness in the oil sector, the strong dollar and some global weakness. But this doesn’t mean the US will enter a recession. The last time the index contracted was in 2012 (no recession), and has shown contraction a number of times outside of a recession. Looking at the economic data, the odds of a recession in 2016 are very low (extremely unlikely in my view). “

Maybe it won’t be in 2016. But the factors for a new recession are increasingly in place: falling profitability and profits in the major economies and a rising debt burden for corporations in both mature and emerging economies. And the Fed set to hike the cost of borrowing in dollars. It’s a poisonous concoction.

No hay comentarios:

Publicar un comentario